North America accounted for 12 percent of lithium demand last year. By 2030, Albemarle expects North America to comprise 20 percent of global demand. As that demand rises, more will be locally produced.

Battery cell manufacturers and automakers are investing billions to localize the EV supply chain.

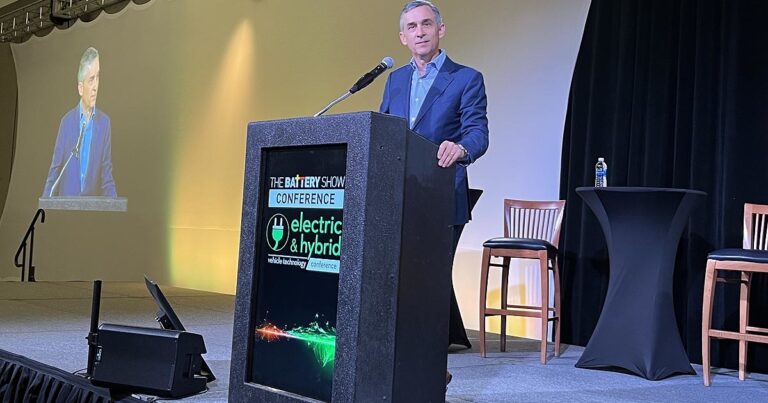

The Inflation Reduction Act has allowed Albemarle to increase its business in the U.S. The company’s best lithium resources are in Chile and Australia, but the next-best lithium sites are in North America, he said. The company is opening a mine in Kings Mountain, N.C.

“It is every bit as good as the resources … in Australia. And it’s in our backyard,” Norris said. “What the IRA did was de-risk and accelerate that.”

Even as mining becomes more prevalent in North America, local battery material processing lags. About a third of materials are processed in North America and free-trade partner countries. Albemarle doesn’t expect that share to grow by 2030. Most processing has been done in China.

“The know-how to do that is sparse,” Norris said.

But the need to build processing centers in North America is imperative. It aids national security and allows companies such as Albemarle to take advantage of the Inflation Reduction Act incentives. And it shortens the length of customers’ supply chains, a newfound focus after pandemic-era disruptions.